GST- What Lies Beneath: the impacts and costs of GST

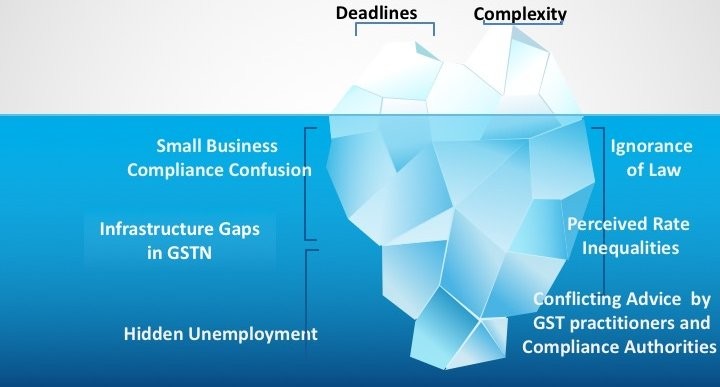

The impacts and costs of GST are more far-reaching than they appear on the surface. What we are seeing being reported in the form of revenue sharing issues with State Governments, implementation hurdles and compliance is just scratching the surface. We need to dive deeper in search of the root causes and understand the larger malaise.

I got this remarkable insight during my regular visit to the Barber last week. For those of you who have seen the halo around me, this may sound a little incongruous but as I am sure you would understand as your stock of something precious dwindles for reasons beyond your control, the more likely that you would take better care of what still remains. I usually chat with the barber while he locates what needs trimming and occasionally need to rein him back, as he gets quite excited when he locates a cluster that he can actually work with. A bit of banter keeps him focused. Talking of focus, back to the point-GST-A Barber's Perspective...

During our chat, I discovered that the Barbershop usually opened at 7 am and had now changed its timing to 9.30am. Another change I noticed was that there were only 3 persons as compared to the 8-10 people employed earlier. When I enquired as to why business was down, I was told that it was all because of GST and that the government had little concern for small traders. Despite GST being a key area of my work, I could not for the life of me understand how GST could possibly impact a barber.

The story that emerged was revealing. The shop was located near the now redundant Octroi check post. There were about three to five hundred trucks queued up waiting to be weighed and assessed for Octroi daily in the pre-GST days. Many of the truck drivers and the Octroi agents were regular visitors to the Barber's shop for a daily shave and just a chat with the friendly neighborhood barber. With the abolition of Octroi, not just the barber but other ancillary industries lost a major part of revenue viz. tea shops, roadside snack stalls, commercial buildings which housed the Octroi agents, truck repair, and service outlets which tended to the trucks while they waited etc.

Like so many others I had rejoiced at the abolition of Octroi as a victory for the common man, but it took a lesson in economics from my barber, for me to realize that it was not all hunky dory for everyone. The relatively larger businesses redeployed their funds and capital elsewhere to align with the changing times. The smaller entrepreneurs were worse hit with overheads, pending bank loans and low rental returns for property owners. The working class which was supported by these businesses had lost their livelihoods or at least a substantial part of their monthly income and some of them were now driving Autos, "Ubers" and "Olas" for a living buried under "friendly" loans.

Digging deeper, I learned of Xerox shops and consultants who had set up shanties outside the VAT and Service Tax Offices that were now redundant and deserted. The complete automation and relative complexity of the GST regime had left the field open for Chartered Accountants and other more advanced practitioners to roam free.

That old fox Darwin has ingrained in all of us that one should adapt to survive. My economist friends propound the theory that the above anecdote is simply a case of a lost locational advantage which would transfer to another part of the economy. Those from the bureaucracy will talk of collateral damage while implementing wide-ranging structural reforms which are just not just desirable but are imperative for the survival of our economy in the modern world. Some may even argue that this is the foundation for job creation and provide a fillip to economic growth. In view of the sheer scale and magnitude of the reforms, some teething troubles are expected. Try explaining that to my barber who is just representative of the hundreds of thousands of people who would have been impacted in Octroi posts across the country.

Modern management jargon advises us to innovate to survive and the buzzword is "Perform or Perish". References are made to that old fox, Darwin who is often quoted out of context! His work about the Origin of the Species is about species in general while in this anecdote we are talking about individual members of the human race. As legislators, industry leaders and professionals, it is incumbent on us that when we legislation is passed with the intent of the general long-term good, to build a framework that works to retrain and upscale those of us whose skills have lost their value and ensure that they adapt to the new regime. The adage that anyone who cannot adapt would become extinct like a dinosaur does not apply here!

Continuing to dig deeper, the Octroi posts and related displacement and disruption is just one part of the iceberg. Small businesses are being shunned by Corporates because they do not provide GST invoices. Some of the Corporates and larger businesses have not understood the provisions of the reverse charge mechanism which would give them the same degree of compliance and credit offset. Other smaller businesses are misled into a wrong registration since they are unaware of the Composition Scheme for those who deal in goods where the GST impact would be only 1%.

I have since met other small traders who supply primarily to domestic markets and have registered for GST even though their turnover is below the threshold limit. They have subsequently hiked their prices in a range of 18 to 28%. Their customers are driven to the unorganized and non-compliant sector which does not charge GST. Part of the reason for over-compliance is that the implementation of GST has assumed a draconian face despite the efforts of those in charge. A lot more needs to be done in terms of improving perceptions and educating the small traders and businesses on how to structure and reorient their businesses in the new scenario. GST has far greater implications for trade and commerce which need to be understood and addressed.

In addition to the registration/return confusion, there have been the usual teething problems with the GSTN network. Other frustrations faced by the taxpayers include

- GST practitioners who have given their personal phone and email ids in the GST form which means that the client does not have control on his own GST account.

- Ability to change these details is not available to the GST account holder on the site. It is under implementation and would be a welcome relief when available

- Issues with GSTN network and the portal which thankfully appear to be reduced at the time of writing this article

- Several businesses are still unable to provide GST invoices and I know quite a few large corporates who paid their July GST in September and some businesses are still struggling to get their act together. The scenario will get worse before it gets better when the reconciliation of purchases and sales kicks in after the returns are filed in October. This will necessitate reversing of purchase credits availed which are not reflected in the vendor returns and resultant reversals and rebooking.

- And finally, some of my clients complain that Banks refuse to open current accounts without a GST registration irrespective of nature of business or turnover

Looking at the big picture is good but one must never forget that "GOD" is in the details. Addressing these issues of ignorance, hidden unemployment and bridging both the skill and infrastructure gaps should be the top priority of GST professionals, Technocrats, Authorities, Bureaucrats as well as the National Skill Development Board. In absence of concerted efforts towards this end, the benefits of a unified tax regime may be outweighed by the costs to the working class and the small businesses.

This could be compounded by unscrupulous practitioners who are hand in glove with the implementation authorities. Even though they are hopefully a "controllable minority" the perception damage caused by their weapons of coercion, intimidation and extortion may be irreparable. Given the extent of automation and transparency in Income Tax and ROC related activities the scope for such activities is considerably reduced and GST with the mystery and confusion clouding its perception is a major opportunity for such unscrupulous elements.

This is not something the Government can tackle on its own but requires participation from all those involved to make sure that small, medium and large businesses are empowered to take the right decisions to enable their ventures not just survive but thrive in a GST regime.

As we approach the auspicious day of Dusshera and celebrate the victory of good over evil, we must all work together to ensure that our achievement in obtaining a transparent and unified tax regime in GST does not turn out to be a Pyrrhic victory. As someone wisely said, "the path to hell is paved with noble intentions."

Any thoughts or suggestions are welcome as are any other issues you have unraveled in the course of your work.